A series of interesting headlines came out from Greentech media, and it is worth seeing them in order:

US Solar Market Grows 95% in 2016, Smashes Records

Understanding America’s Record-Shattering Year for Solar—and the Coming Slowdown

Here’s How Nearly 15 Gigawatts of Solar Gets Built in One Year

First Solar Posts Better-Than-Expected Q4, Raises 2017 Guidance, Preps New Module Production

One of the data points that stuck out to me during my research as a graduate student and again as a market analyst was the consistently conservative projections by even the most optimistic of forecasters. Everyone from the Energy Information Administration to the International Energy Agency got their projections wrong:

Even the folks at Greentech are rapidly proven wrong, as industry players report a stronger 2017 than expected. To be completely fair, a far slower 2017 was the consensus that I agreed with. 2016 saw a massive rush to complete utility scale wind and solar power plants before the expected sunset of a renewable tax credit. Surprisingly, Congress extended that tax credit until 2021. While some projects were shifted off into 2017, most projects kept their projected 2016 completion date. Most credible experts saw the 2016 rush as a one-time deal spurred by the expected expiration of the tax credit, and that growth rates would normalize.

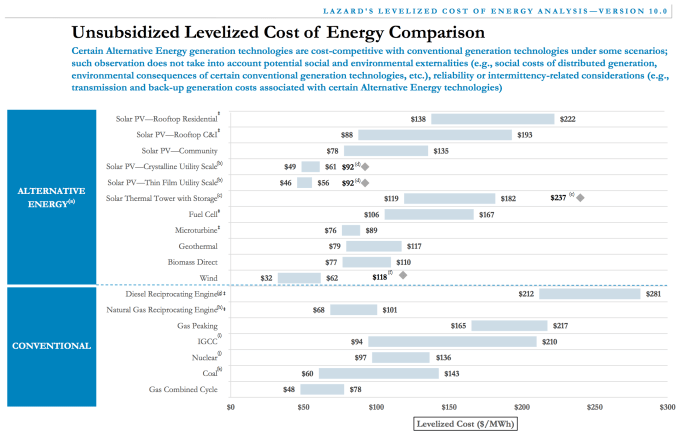

Early indications tell us that this is not the case. While it is doubtful that the United States can nearly double its annually installed solar capacity again, the industry has hit a crucial tipping point; solar and wind are now effectively cheaper than coal and gas fired power plants:

While there are efforts to slow down the adoption of solar and wind by other means, the economic argument for solar and wind is getting harder to ignore. The fuel for these technologies is free, and technology only gets cheaper over time. This means that the cost of using these fuels is the up-front capital cost and subsequent maintenance costs, all of which can be modeled out and planned for, offering unprecedented stability to businesses and governments. Any subsequent expansions are almost guaranteed to produce more power at a lower cost, as the cost of doing business goes down and technology becomes cheaper and/or more efficient.

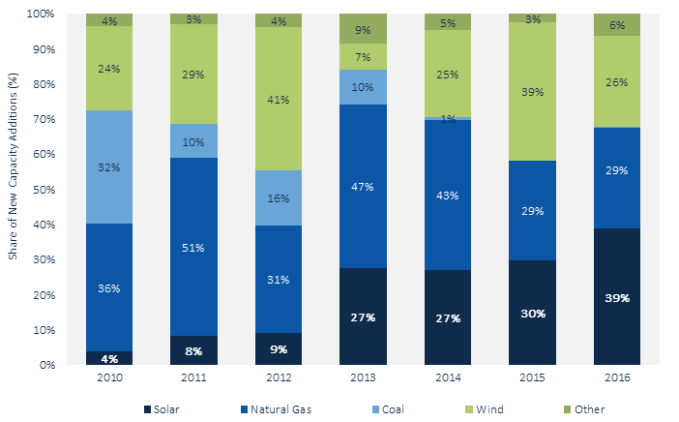

There is yet another tipping point to hit, and that is battery storage reaching a price point where it becomes economically feasible to implement it at the utility level. Remember that storage doesn’t have to account for 100% of the power that we consume, merely enough to smooth out the intermittency issues that wind and solar face. Once the cost of wind and solar + storage is as cheap as a new gas power plant, we’ll see a true sea change. Look at what happened to new coal fired power plants over the past 6 years, and what’s happened to gas fired coal power plants over the last 2 years:

New coal power plants have all but ceased, and gas has held steady after dramatic growth and falling prices in the first 4 years. This is particularly important as power plants are usually rated for 40-60 years of use, and every plant that is built today will endure well into the middle of the century.

To recap, the first tipping point is when wind and solar are competitive with coal and gas on their own, making them economically viable as supplements to the grid. The second tipping point makes wind and solar economically viable as the default main contributors to the grid going forward.

The third tipping point is the nail in the coffin for fossil fuels, and that’s when a new wind and/or solar + storage installation is cheaper than running an existing coal and/or gas power plant. At that price point, we can expect to see two things.

The first is a change that dwarfs the previous two on a global scale. India and China have installed dozens of new coal and gas power plants during their meteoric economic rise, but they aren’t the only culprits. Even as late as 2014 the United States was still installing new coal power plants. Most of these plants would likely be shuttered barring increased state subsidies, a move that would be hard to justify when it essentially means that governments would be paying twice (once as a subsidy, and again as a consumer) for outdated technology that harms their citizens. This tipping point would represent an effective retooling of our energy grid retroactively, changing the majority of our energy mix in a hurry.

The second thing we can expect is a a ferocious fight from the owners of coal and gas power plants. The third tipping point would effectively devalue their plants to near 0, and the owners of those plants would seek to protect their investments as long as they can by policy support. If you think the fight against wind and solar has been nasty so far, I suspect we haven’t seen the worst of it yet.

That said, the first point has already been hit, and the second point will likely be hit within the next decade, if not sooner. The third is a big stretch, and would require an unprecedented drop in battery technology costs. However, if we do hit it (and I expect we will), it will go a long way to addressing our climate change challenge.

Who knows if any new coal or gas power plants will be built after the year 2050? One can only hope.

Sources:

US EIA Responds To CleanTechnica Letter/Criticism On Energy Forecasts

The International Energy Agency consistently underestimates wind and solar power. Why?

Low Costs of Solar Power & Wind Power Crush Coal, Crush Nuclear, & Beat Natural Gas